Why Are Self-Employed Clients Still Struggling to Get Approved for Mortgages... Even When They’re Making Six Figures?

Discover the Self-Employed Mortgage Optimization Plan That Helps Loan Officers Close More Deals – Faster, Smoother, and Without Underwriting Nightmares.

❌ The Ugly Truth About Self-Employed Mortgage Applications...

You know the drill...

The client is a high-earning business owner.

Their credit score is solid.

They’ve got cash in the bank.

The deal looks promising...

...until underwriting starts combing through two years of tax returns and sees write-offs that make the income disappear.

🧨 BOOM – the loan collapses, along with your homeownership dreams.

But What If You Could Eliminate These Headaches at the Source?

Imagine if every self-employed buyer you worked with showed up:

With income structured to meet lender guidelines

With tax strategies that align with underwriter expectations

With NO confusion about “what counts” as income

With YOU as the hero who made it all possible

That’s exactly what my Self-Employed Mortgage Optimization Plan does.

For Loan Officers, Brokers & Lenders Who Are Tired of Watching Good Deals Die in Underwriting…

MEET THE FOUNDER of

Hey, I'm Dan Mullen!

I created this program after watching too many smart, high-earning entrepreneurs get denied for mortgages — not because they couldn’t afford it, but because they didn’t look good on paper.

I work directly with your self-employed clients to optimize their financial structure and taxes BEFORE they apply — so you can close more loans, faster, and with less stress.

Here’s How It Works In 3 Easy Steps:

Client Intake + Financial Diagnostic

We evaluate their current tax situation, business income structure, and mortgage readiness.

Custom Optimization Strategy

We design a tax and income alignment plan that suits underwriting guidelines — no shady accounting, just smart positioning.

Loan-Ready Packet Delivery

We provide you (and your underwriter) with clean, strategic documentation that helps get the deal done.

Results You Can Expect:

✅ More loans funded — especially complex 1099/entrepreneur clients

✅ Shorter underwriting timelines

✅ Happier clients who refer more business

✅ You positioned as the trusted advisor who “knows a guy who can get it done”

Results You Can Expect:

✅ More loans funded — especially complex 1099/entrepreneur clients

✅ Shorter underwriting timelines

✅ Happier clients who refer more business

✅ You positioned as the trusted advisor who “knows a guy who can get it done”

Why This Matters Now:

With housing inventory low and competition high, lenders can’t afford to lose deals because a client’s Schedule C didn’t “look right.”

Every declined loan is a missed commission, a lost relationship, and a dent in your reputation.

Don't let your pipeline depend on messy paperwork and misunderstood finances.

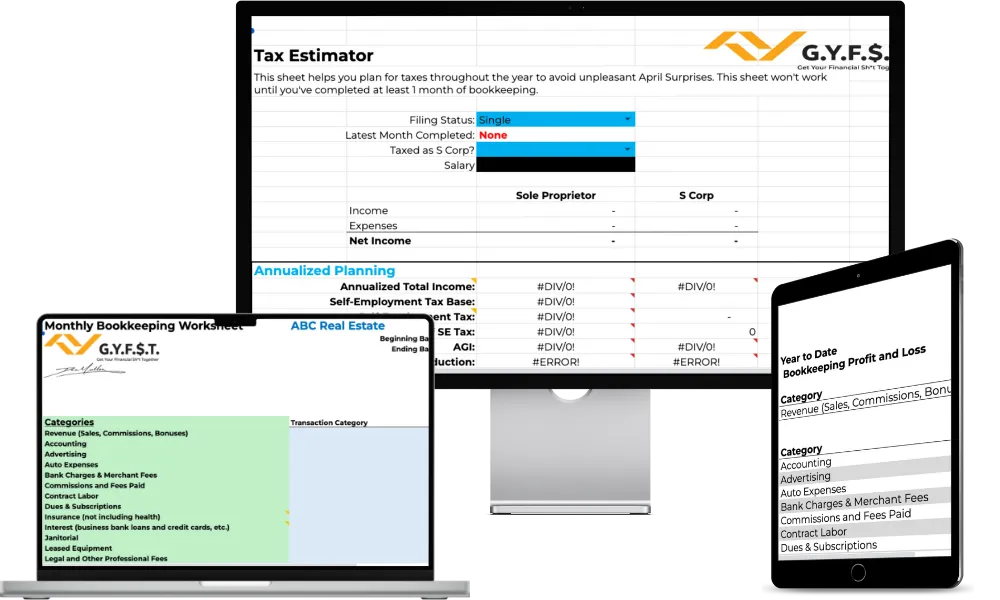

Help Your Clients Get Their Financial Sh*t Together?

Book a Free 15-minute Call To Get Started

GYFST.net - Copyright © 2025 - GYFST LLC - All Rights Reserved - Terms of Service - Privacy Policy - Disclaimer

Dan Mullen and/or GYFST LLC cannot and does not make any guarantees about your ability to get results or earn any money with our ideas, information, tools, or strategies. Nothing on this page, any of our websites, or any of our content or curriculum is a promise or guarantee of results or future earnings, and we do not offer any legal or other advice. Any financial numbers referenced here, or on any of our sites, are illustrative of concepts only and should not be considered average earnings, average savings, exact earnings, exact savings, or promises for actual or future performance. Use caution and always consult your accountant, lawyer, or professional advisor before acting on this or any information related to your business or finances. You alone are responsible and accountable for your decisions, actions, and results in life and business, and by your registration here, you agree not to attempt to hold us liable for your decisions, actions, or results at any time, under any circumstance. This site is not a part of the Facebook website or Facebook Inc. Additionally, this site is not endorsed by Facebook in any way. Facebook is a trademark of Facebook, Inc.